Capital gains calculator with depreciation

Total Value of Improvements. If depreciation rules didnt apply you would have a 400 capital loss.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

An investor that holds property longer than 1 year will be taxed at the favorable capital gains tax rate.

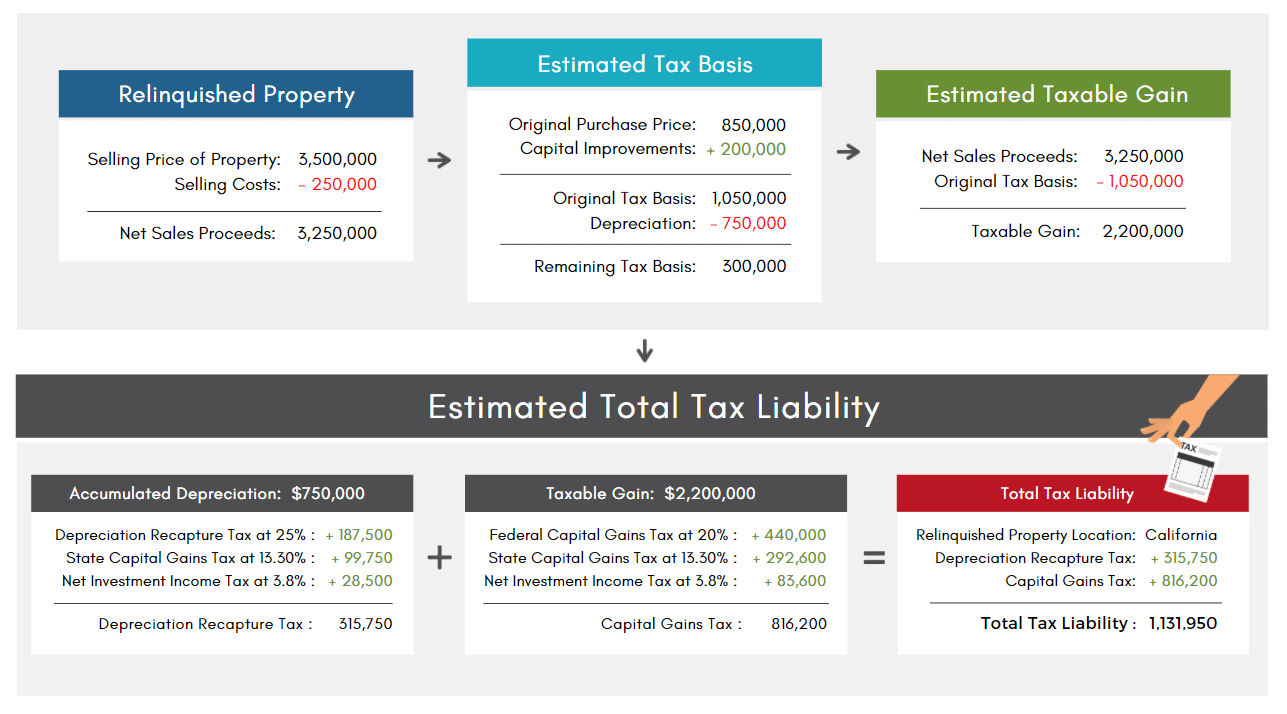

. 2022 Capital Gains Tax Calculator. In addition to Capital Gains Tax Accumulated Depreciation Recapture tax is also deferred with a 1031 Exchange. Federal Capital Gain s Tax is between 15-20 depending upon annual household income.

If youre wondering how to calculate capital gains on rental. In this example subtract 900000. Gains from the sale of depreciable assets.

Depreciation is a tax deduction you can claim on your propertys costs of owning and improving it. Total Tax if the property is sold. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too.

Ad TIAA Can Help You Create A Plan For Your Future. You take 100 per year in depreciation and four years later you sell it for 600. New Hampshire doesnt tax income but does tax dividends and interest.

This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. It may not account for specific scenarios that could affect your tax liability. IRS imposes depreciation recapture tax if you had claimed depreciation on the property in the past.

The gain not the profit or equity from the sale of the investment property is subject to a combination of capital gains taxes Medicare tax and the tax on the recapture of depreciation. However because you claimed four years. Heres a quick and easy way to estimate your capital gains tax liability.

Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. It is possible to have little or no equity or profit upon a sale and still owe capital gains taxes. 300000 and click on the Calculate button in each area to perform the calculations.

Depreciation recapture tax rates. APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. Recapture of all Section 1250 depreciation allowed see Note 4 45000 x 25 11250.

Please enter your figures in the fields provided enter your numbers with no commas or dollar signs for example. Of additional equity available to reinvest through a 1031 exchange. Section 50 of the Income Tax Act states that if an assessee sold a capital asset that was a part of a block of assets such as a building or piece of machinery for which depreciation was permitted under the Income Tax Act the income from that capital asset was considered to be of a short-term nature.

Subtract your adjusted basis from your selling price to determine your total capital gain. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Subtract 100000 from 1 million to get a 900000 adjusted basis.

Previously the cap was 15. Capital Gains Tax on Profit See Note 6 Adj Selling Price less Adj Cost Basis 310000 x 15. Dont Wait To Get Started.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your income tax rate with a cap at 25. 2022 real estate capital gains calculator gives you a fast estimate of the capital gains tax. Costs of Sale transactional expenses commissions.

Learn How Our Online Tools Can Help Answer Your Important Financial Questions. Use this tool to estimate capital gains taxes you may owe after selling an investment property. Capital Gains Taxes on Property.

For instance a widget-making machine is said to depreciate when it produces fewer widgets one year compared to the year before it or a car is said to depreciate in value after a fender bender or the discovery of a faulty transmission. If the investor does not move forward with an exchange then the transfer of property is a sale subject to taxation. These calculations show the approximate capital gain taxes deferred by performing an IRC Section 1031.

Utilize our Depreciation Calculator below to find the annual allowable Depreciation for your real estate investment property as well as the Accumulated Depreciation of the property over the course of ownership. The calculator computes both for 2022 and 2021. Your depreciation recapture tax rate will break down like this.

Otherwise the sales gain is taxed at the ordinary income rate. State Capital Gain s Tax varies by state and income level 5 is just an estimate used as the default above. Since depreciation is not a cash expense it lowers your tax rate and improves your cash flow.

State Tax Rate ex. A good capital gains calculator like ours takes both federal and state taxation into account. State Income Tax Note 5 Example rate is for Virginia Tax Rate 575 x Line 9.

The amount of depreciation you claim is the propertys value divided by 275 years. This 25 cap was instituted in 2013.

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Depreciation Formula Calculate Depreciation Expense

Depreciation Schedule Formula And Calculator Excel Template

Calculate Your Tax Savings With Limited Amount Of Effort Using Bonus Depreciation Calculator

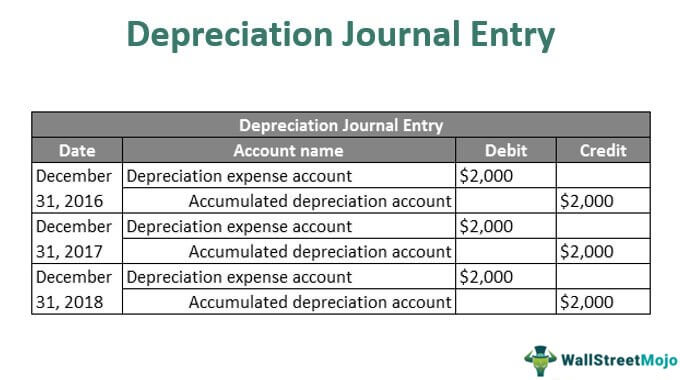

Depreciation Journal Entry Step By Step Examples

Operating Cash Flow Ocf Cash Flow Statement Cash Flow Budget Calculator

Depreciation Tax Shield Formula And Calculator Excel Template

Balance Sheet Current Year Calculator Use The Balance Sheet Calculator To Calculate Spreadsheet Template Balance Sheet Template Personal Financial Statement

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

San Diego Capital Gains Tax On Rental Property In 2022 Mortgage Loans Rental Property San Diego Real Estate

Selling Your Investment Property How To Calculate Your Tax Liability

Depreciation Calculator Definition Formula

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Balance Sheet Templates 15 Free Docs Xlsx Pdf Balance Sheet Template Balance Sheet Accounting

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Depreciation Schedule Formula And Calculator Excel Template

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness